WASHINGTON — U.S. Department of Education officials on Tuesday touted several improved performance metrics for the latest Free Application for Federal Student Aid, including low call center wait times, high shares of students and families reporting satisfaction with the form, and the earliest form launch in history.

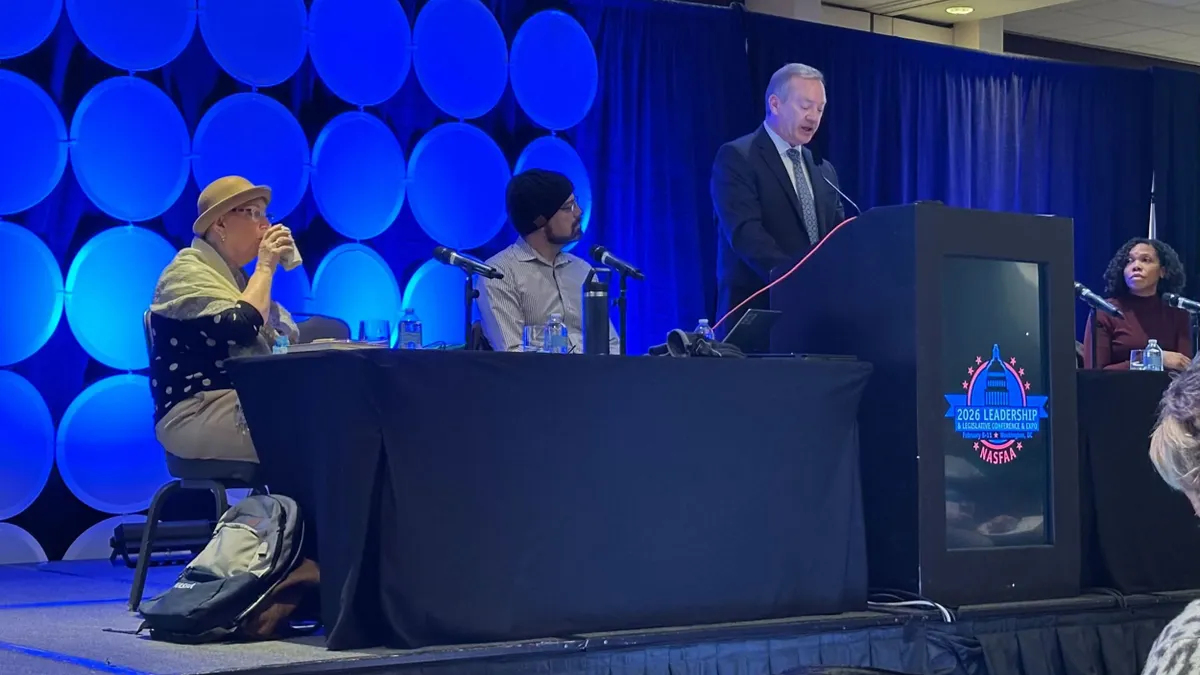

Officials shared the update during the National Association of Student Financial Aid Administrators’ legislative conference this week.

So far, some 8 million students have submitted the 2026-27 form, according to FAFSA Program Executive Director Aaron Lemon-Strauss, who joined the agency in 2024 under the Biden administration as the agency sought to get the FAFSA back on track after a tumultuous aid cycle. The Education Department launched the latest form on Sept. 24, about a week before the statutory deadline.

Lemon-Strauss also pointed to recent data from the National College Attainment Network, which found that 1.7 million more students were eligible for the maximum Pell Grant during the last cycle than during the 2023-24 cycle, which was the last one before legislation took effect to expand Pell eligibility and simplify the FAFSA form.

That legislation, the FAFSA Simplification Act, pared down the maximum number of questions students and their families had to answer from over 100 to several dozen.

However, the Education Department’s initial rollout of the revamped form roughly two years ago was plagued by delays, last-minute changes and technical difficulties that made it difficult for students and their families to complete the form.

In 2023, the Education Department didn’t roll out the FAFSA until Dec. 30, about three months later than usual. The next year, the form debuted on Nov. 21. In response, lawmakers passed legislation requiring the agency to make the form available by Oct. 1 each year.

“We went through some rough patches on the implementation,” Lemon-Strauss told the NASFAA conference. “Once we could get the implementation right, we're now seeing the results.”

Lemon-Strauss said the current form has a 96% satisfaction rate, up from 94% for last cycle’s form. The satisfaction rate captures the share of students and parents who completed the FAFSA and rated it at least four stars out of five.

A slightly smaller share, 92%, have said the FAFSA this cycle is taking a reasonable time for them to complete, according to Lemon-Strauss.

He also touted the FAFSA call center’s wait times for the current cycle, which were under one minute on average through Jan. 30. The Education Department’s call center drew criticism during the rocky rollout two cycles ago, when families reported long wait times or being hung up on when they sought help.

A 2024 report from the U.S. Government Accountability Office found that roughly three-quarters of calls to the Education Department’s call center weren’t answered during the first five months of that rollout.

“For anyone who hasn’t sort of caught up to the fact that the contact center is, you know, now working, it is,” Lemon-Strauss said. “Please feel free to have students and families call for help.”

Lemon-Strauss also updated conference attendees on the Education Department’s efforts to crack down on financial aid fraud.

Last June, the agency announced that it would require colleges to verify the identities of some 125,000 first-time applicants for federal financial aid who were enrolled in the summer term. At the time, the Education Department said the requirements were temporary while the agency worked on a new process to detect fraudulent applications.

The verification flagging in June was important to ensure money didn’t go “out the door to fraudsters.” Lemon-Strauss said. He added that the Education Department flagged tens of thousands of other students for verification in August as well.

Data from the identity verification measures helped train the Education Department’s fraud detection model and gave the agency more confidence in the technology, Lemon-Strauss said.

The agency’s system gives each applicant a score ranging from 1-99 for potential fraud, he explained. In August, the agency targeted applicants with a score of 94 or above, resulting in 180,000 being flagged.

However, the Education Department now plans to raise that threshold to scores of at least 96.

“By the time you got down to sort of 94 on the fraud score, the false positive rate felt a little too high to us,” Lemon-Strauss said. Those with a score of 99 had a false positive rate of just 0.4%, Lemon-Strauss said.

The Education Department is currently working on developing a process to handle identity verification for FAFSA applicants that doesn’t overly burden colleges or prevent aid from flowing to students who trigger false positives.

“The goal of the FAFSA isn't to block fraud,” Lemon-Strauss said. “The goal of FAFSA is to increase access to student aid. So we need there to be a way that if there are false positives, that student can still have access to student aid, they're not shut out of the system. And so those are the details we're figuring out.”